A pension fund group with more than $3 trillion in assets recently sent a letter to the U.S. securities regulators requesting that they amend or create rules to stifle insider trading among executives. The Council of Institutional Investors (CII) was said to be concerned about “corporate insiders …abusing their position by improperly profiting from trading their company shares while in possession of confidential information,” according to the Wall Street Journal Online. The Journal Online states that the Council of Institutional Investors is a nonpartisan group of public, corporate and union pension funds, foundations and endowments.

The group’s letter stated that they were concerned “many executives at public companies have adopted practices… that are inconsistent with the spirit, if not the letter of the U.S. securities law. Unfortunately, according to securities attorney James Kauffman, “with the significant portion of Dodd-Frank still not funded, the SEC does not have the horsepower to monitor the trades.”

The group is asking for interpretive guidance regarding 10b5-1 plans. The plans, which are made in advance, allow executives to trade even when they have confidential information. The possession is counter-manned by the “preconceived” trading plan. That plan serves as a strong defense against insider trading allegations.

The civil and criminal investigations surrounding VeriFone’s Chief Executive Douglas Bergeron, stand as an example of how the plan is used. Bergeron sold his stock for a profit before an expected slump and relied on his 10b5-1 plan that was set up two months prior. So far, the investigations continue to surround the validity of this defense and the CII’s contention that it is merely a sham.

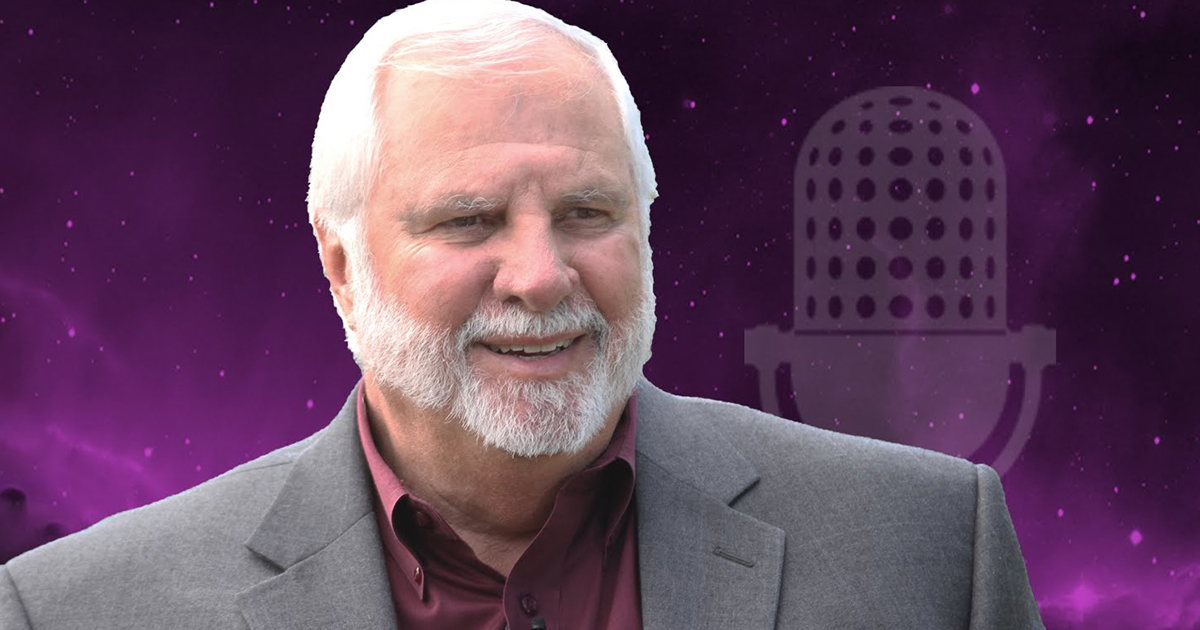

Erica Reed is an associate attorney at Levin, Papantonio, Thomas, Mitchell, Rafferty & Proctor, P.A. She is a member of the Business Torts Department of the firm. Her practice focuses primarily upon representing individuals and entities in the areas of securities litigation and arbitration, as well as complex business and antitrust litigation.