It’s yet another dirty little Wall Street secret: while financial advisers and brokers are ethically obligated to put the interests of their clients first, such obligations do not necessarily have the force of law. As a result, those advisers are steering clients into high-risk investments that generate big bucks in the way of commissions for themselves, while costing clients billions of dollars. Those clients include retirees who have worked for a lifetime to provide for themselves. Now, thanks to having put their trust in advisers who are motivated solely by greed, they are spending their “golden years” bagging groceries and greeting customers at Walmart.

It’s been going on far too long. Earlier this year, the Obama Administration proposed federal regulations that would change the way in which financial advisers and brokers are compensated. Developed by the Department of Labor for the protection of retirees, the new regulations would change broker compensation from a commission-based model to a fee-based one. This would reduce broker incentives to put clients into high-risk investments, particularly those with smaller accounts.

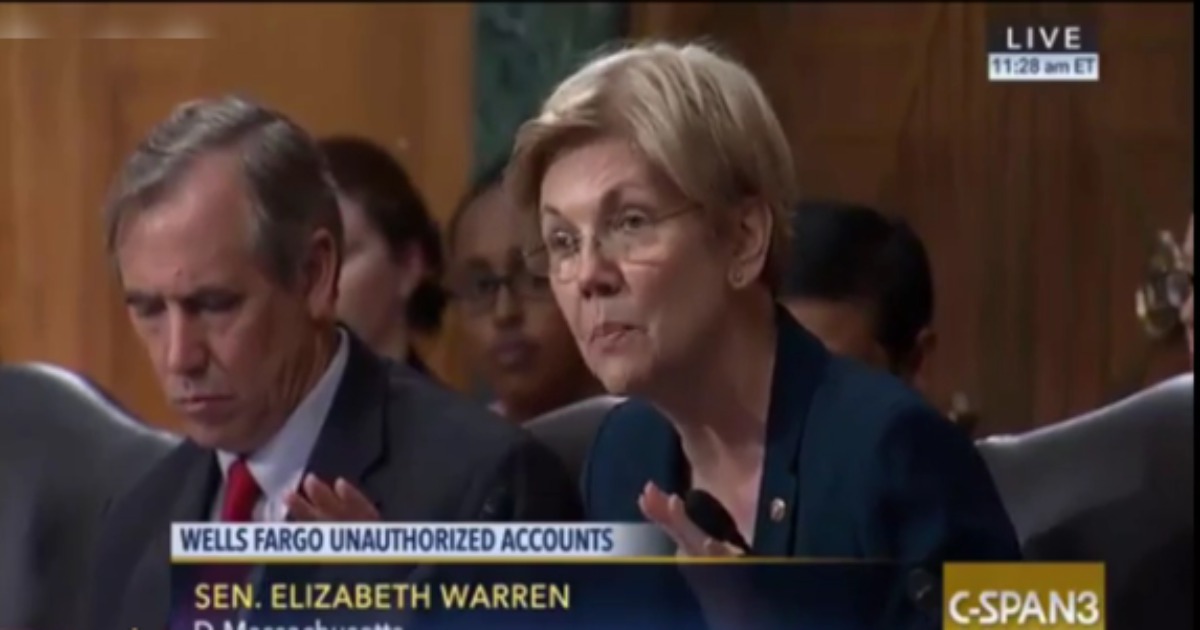

As one would expect, the financial “services” industry has been denying allegations of abuse by advisers and brokers. Wall Street, not surprisingly, has been fighting the new fiduciary duty regulations tooth and nail. One unnamed source told The Hill in January that a White House memo on the issue is “cherry-picked with facts” and was primarily intended to “placate Elizabeth Warren and the Warren-wing of the Democratic Party.” Senator Warren has been among Wall Street’s harshest critics.

One of the primary issues, according to the AARP and Progressive organizations, is that the majority of clients planning for retirements are not aware of the commissions their brokers receive when steering them into potentially high-risk retirement plans. The new rule, announced in February, would put a stop to “hidden fees that hurt consumers and back-door payments that help Wall Street brokers,” according to senior White House adviser Brian Deese. A statement from the Obama Administration said that the new rules are necessary because of “outdated regulations, loopholes and fine print [that] make it hard for working and middle-class families to know who they can trust.”

Wall Street is whining that the new regulation is too “complex,” and it will increase retirement costs for small companies while reducing transparency. Isn’t that the problem right now?

One thing is certain: with billions in fees and commissions at state, the Wall Street thieves are unlikely to back down – and with the number of financial industry lapdogs and lickspittles in CON-gress, President Obama and Progressive lawmakers face an uphill battle.